Paper Solutions

Dear Student,

April -2017 University Question Paper is available on following link -

https://www.scoreachievers.com/qp_hs.htmlPrinciples of Hotel Accountancy

April 2017FYBsci (HS) Sem II

| Q.1 A) Explain the concept- | ( 5 Marks) |

- Capital -

It is amount invested in the business by its owners. It may be in the form of cash, goods, or any other asset - Liabilities – It is an obligation of financial nature to be settled at a future date. Examples of Liabilities are Bills Payable, Bank Overdraft, Creditors etc.

- Goods-

These are tangible article or commodity in which a business deals. E.g. For Soap manufacturing company “Soap” is a Good. - Creditors –

A creditor may be a bank, supplier or person that has provided credit to a company. In other words, a company owes money to its creditors. - Insolvent –

6. The term “insolvent” means that a company can no longer pay their creditors as and when payments are due, and their liabilities exceed their assets.

Q.2 A)

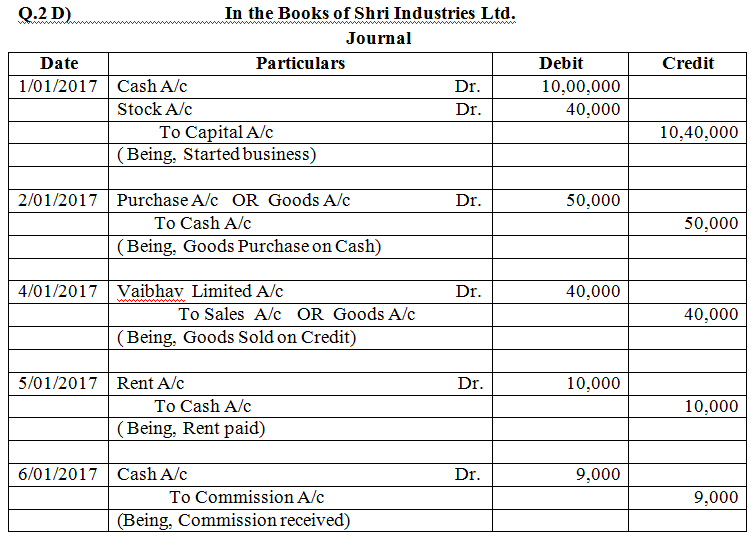

Q.2 A) Journal –

A journal is a record of financial transactions in order by date. A journal is often defined as the book of original entry. The process of recording transaction in a journal is called as ‘Journalisation’. The entry made in this book is called a ‘journal entry’.

Importance of Journal- Journal provides records of all business transactions in one place on the time and date basis.

- All transactions are recorded on the basis of receipts or bill, so we can check authenticity of each journal entries with their bills.

- There is minimum chance to avoid any particular transaction because in journal transactions are recorded date basis.

- Accountant writes every journal entry’s narration bellow of that journal entry, so other auditor can know what the reason of that journal entry is.

- In journal, every transaction is recorded after deep analysis of two accounts on the basis of double entry system, so there is minimum chance of mistake in journal.

- Journal is the basis of posting in ledger accounts. With making of journal, accountant can not make ledger accounts.

- If there is mistake in ledger, we can rectify it with the help of journal or rectify journal entry in journal.

(i) Division of work :

Since in the place of one journal there will be so many subsidiary books, the accounting work may be divided amongst a number of clerks.

(ii) Specialisation and efficiency :

When the same work is allotted to a particular person over a period of time, he acquires full knowledge of it and becomes efficient in handling it. Thus the accounting work will be done efficiently.

(iii) Saving of the time :

Various accounting processes can be undertaken simultaneously because of the use of a number of books. This will lead to the work being completed quickly.

(iv) Availability of informations: Since a separate register or book is kept for each class of transactions, the information relating to each transaction will be available at one place.

(v) Facility in checking:

When the trial balance does not agree, the location of the error or errors is facilitated by the existence of separate books. Even the commission of errors and frauds will be checked by the use of various subsidiary books.

(i) Providing Information to the Users for Rational Decision-making

The primary objective of accounting is to provide useful information for decision-making to stakeholders such as owners, management, creditors, investors, etc..

(ii) Systematic Recording of Transactions

The financial records are classified, summarized and reposted in the form of accounting measurements to the users of accounting information i.e., stakeholder.

(iii) Ascertainment of Results of above Transactions

‘Profit/loss’ is a core accounting measurement. It is measured by preparing profit and loss account for a particular period.

For example, Income Tax Act requires that every business should have an accounting system

that can measure taxable income of business and also explain nature and source of every item

reported in Income Tax Return.

(iv) Ascertain the Financial Position of Business

‘Financial position’ is another core accounting measurement. Financial position is identified by preparing a statement of ownership i.e., Assets and Owings i.e., liabilities of the business as on a certain date. This statement is popularly known as balance sheet.

(v) To Know the Solvency Position

Balance sheet and profit and loss account prepared as above give useful information to

stockholders regarding concerns potential to meet its obligations in the short run as well as in the long run.

Q.3 A)

Q.3 A) Bank Reconciliation Statement

A statement which is prepared to reconcile the causes of difference between Bank Balance as per Cash Book and Bank Balance as per Pass Book/ Bank Statement is known as a Bank Reconciliation Statement.

Importance of Bank Reconciliation Statement

- It helps to understand the actual Bank balance.

- It helps to identify the mistakes in the Cash Book and the Pass Book.

- It helps to detect and prevent frauds and errors in recording the Banking transactions.

- It helps to incorporate certain expenditures/income debited/credited by Bank in the books of accounts.

Trial Balance –

Trial balance may be defined as a statement or a list of all ledger account balances taken from various ledger books on a particular date to check the arithmetical accuracy.

Purpose of a Trial BalanceIt serves the following purposes:

- To check the arithmetical accuracy of the recorded transactions.

- To ascertain the balance of any ledger Account.

- To serve as an evidence of fact that the double entry has been completed in respect of every transaction.

- To facilitate the preparation of final accounts promptly.

Q.4 A)

Importance of Trading Account

- Trading account shows the relationship between gross profit and sales that helps to measure profitability position.

- Trading account shows the ratio between cost of good sold and gross profit.

- Trading account gives the information about efficiency of trading activities.

- Trading account helps to compare between cost of good sold and gross profit.

- Trading account provides information regarding stock and cost of good sold.

- Profit and loss account gives the actual information about net profit or net loss of the business for an accounting period.

- Profit and loss account gives the actual information about indirect expenses.

- Profit and loss account serves to determine the ratio between net profit to sales.

- Profit and loss account helps in determining the ratio between net profit to operating expenses.

- Profit and loss account helps in controlling indirect expenses.

OR

| Q. 5 Write a Short notes ( Any 3 out 5) | (15 Marks) |

Features of Double Entry System

- (i) Every transaction has two fold aspects, i.e., one party giving the benefit and the other receiving the benefit.

- (ii) Every transaction is divided into two aspects, Debit and Credit. One account is to be debited and the other account is to be credited.

- (iii) Every debit must have its corresponding and equal credit.

- (i) Since personal and impersonal accounts are maintained under the double entry system, both the effects of the transactions are recorded.

- (ii) It ensures arithmetical accuracy of the books of accounts.

- (iii) It prevents and minimizes frauds. Moreover frauds can be detected early.

- (iv) Errors can be checked and rectified easily.

- (v) The balances of receivables and payables are determined easily

- (vi) The businessman can compare the financial position of the current year with that of the past year/s.

- (vii) Helps in decision making.

- (viii) It becomes easy for the Government to decide the tax. Q. 5 B) Subsidiary Books

- Purchases Day Book – for recording credit purchase of goods only. Cash purchase or assets purchased on credit are not entered in this book.

- Sales Day Book – for recording credit sales of goods only. Assets sold or cash sales are not recorded in this book.

- Purchases Returns Book – for recording the goods returned to the suppliers when purchased on credit.

- Sales Returns Books – for recording goods returned by the customers when sold on credit.

- Saving Account:

These deposits accounts are one of the most popular deposits for individual accounts. These accounts not only provide cheque facility but also have lot of flexibility for deposits and withdrawal of funds from the account. - Current Account: -

Current Accounts are basically meant for businessmen and are never used for the purpose of investment or savings. These deposits are the most liquid deposits and there are no limits for number of transactions or the amount of transactions in a day. - Recurring Deposits Account –

These are popularly known as RD accounts and are special kind of Term Deposits and are suitable for people who do not have lump sum amount of savings, but are ready to save a small amount every month. - Fixed Deposits Account: -

All Banks in India offer fixed deposits schemes with a wide range of tenures for periods from 7 days to 10 years. These are also popularly known as FD accounts. - . Joint Account:

A joint account is an account that belongs to more than one person. Joint accounts are often set up by couples that are living together or people who have finances that are closely linked. Both current and savings accounts can be opened jointly. - Bearer Cheque

When the words "or bearer" appearing on the face of the cheque are not cancelled, the cheque is called a bearer cheque. The bearer cheque is payable to the person specified therein or to any other else who presents it to the bank for payment. However, such cheques are risky, this is because if such cheques are lost, the finder of the cheque can collect payment from the bank. - Order Cheque

When the word "bearer" appearing on the face of a cheque is cancelled and when in its place the word "or order" is written on the face of the cheque, the cheque is called an order cheque. Such a cheque is payable to the person specified therein as the payee, or to any one else to whom it is endorsed (transferred). - Uncrossed / Open Cheque

When a cheque is not crossed, it is known as an "Open Cheque" or an "Uncrossed Cheque". The payment of such a cheque can be obtained at the counter of the bank. An open cheque may be a bearer cheque or an order one. - Crossed Cheque

Crossing of cheque means drawing two parallel lines on the face of the cheque with or without additional words like "& CO." or "Account Payee" or "Not Negotiable". A crossed cheque cannot be encashed at the cash counter of a bank but it can only be credited to the payee's account. - Anti-Dated Cheque

If a cheque bears a date earlier than the date on which it is presented to the bank, it is called as "anti-dated cheque". Such a cheque is valid upto three months from the date of the cheque. - Post-Dated Cheque

If a cheque bears a date which is yet to come (future date) then it is known as post-dated cheque. A post dated cheque cannot be honoured earlier than the date on the cheque. - Stale Cheque

If a cheque is presented for payment after three months from the date of the cheque it is called stale cheque. A stale cheque is not honoured by the bank. - Capital expenditures are charged to expense gradually via depreciation, and over a long period of time.

- Revenue expenditures are charged to expense in the current period, or shortly thereafter.

- A capital expenditure is assumed to be consumed over the useful life of the related fixed asset.

- A revenue expenditure is assumed to be consumed within a very short period of time.

- A more questionable difference is that capital expenditures tend to involve larger monetary amounts than revenue expenditures.

- This is because an expenditure is only classified as a capital expenditure if it exceeds a certain threshold value; if not, it is automatically designated as a revenue expenditure.

- However, certain quite large expenditures can still be classified as revenue expenditures, as long they are directly associated with sale transactions or are period costs.

Subsidiary Books are those books of original entry in which transactions of similar nature are recorded at one place and in chronological order.

In a big concern, recording of all transactions in one Journal and posting them into various ledger accounts will be very difficult and involve a lot of clerical work. This is avoided by sub-dividing the journal into various subsidiary journals or books.

The subdivisions of journal into various subsidiary journals for recording transactions of similar nature are called as ‘Subsidiary Books.’

The different subsidiary books and their purpose as below:

***** END *****